Protecting your home and vehicle requires a partner that understands today’s risks. Pride Insurance delivers tailored solutions designed to safeguard what matters most. Whether you own a house, drive a car, or manage multiple assets, their policies blend flexibility with robust protection.

Modern life demands adaptable coverage. That’s why these plans prioritize affordability without compromising quality. Customers benefit from straightforward policy reviews and transparent pricing, making it easier to balance budgets and security.

Collaborating with trusted partners like Nationwide ensures access to On Your Side® Claims Service, available 24/7. This support simplifies claims during emergencies, while local agents provide personalized guidance. Homeowners and drivers gain peace of mind knowing their needs are handled professionally.

Key Takeaways

- Comprehensive auto and home protection plans

- Competitive rates matched with reliable coverage

- 24/7 claims assistance through Nationwide’s network

- Local expertise for tailored policy adjustments

- Streamlined processes for quick updates and renewals

Understanding Your Insurance Needs

Tailoring protection begins by analyzing your lifestyle and assets. Every family’s situation differs, making personalized assessments essential for adequate coverage. Start by listing your most valuable possessions and daily routines – this creates a roadmap for selecting suitable policies.

Home Insurance Considerations

Home coverage should reflect your property’s unique features. Older roofs, swimming pools, or custom renovations often require special endorsements. Location also plays a role – urban areas might need higher liability limits than rural properties.

Consider how often you host guests or run a home-based business. These factors influence your risk profile and policy requirements. A local agent can help identify gaps in standard packages.

Automobile Insurance Essentials

Car insurance costs depend on three primary factors:

- Vehicle make/model (sports cars cost more to insure)

- Annual mileage and garage location

- Driving record and claim history

Teen drivers or long commuters often benefit from usage-based programs. The right blend of collision, comprehensive, and liability coverage varies by driver. One company’s experts review these details to match clients with optimal plans.

Combining home and car policies frequently unlocks discounts while simplifying management. Professional advisors simplify comparisons between products, ensuring you get necessary protections without overspending.

Pride Insurance Coverage Options

Effective asset protection hinges on solutions crafted for individual scenarios. Providers offer diverse plans spanning residential, commercial, and vehicle safeguards. These products adapt to evolving priorities, balancing cost efficiency with thorough risk management.

Customized Home Policies

Homes with unique upgrades or collections require specialized attention. Policies can include endorsements for art, vintage furniture, or smart-home systems. Location-specific risks – like coastal storm surges or wildfire zones – are addressed through tailored clauses.

Renovations or accessory dwellings often demand adjustments to standard plans. A dedicated review process identifies gaps, ensuring additions like pools or solar panels receive proper protection. This approach prevents underinsurance while keeping premiums manageable.

Auto Protection Plans

Car owners benefit from plans that reward safe habits and vehicle safety features. Discounts apply for:

- Anti-theft systems and collision avoidance technology

- Low annual mileage or usage-based tracking programs

- Multi-car households bundling coverage

Teen drivers can access monitoring tools that promote responsible behavior while lowering costs. Partnering with Nationwide enhances claim resolution speed, particularly for complex accidents involving multiple parties.

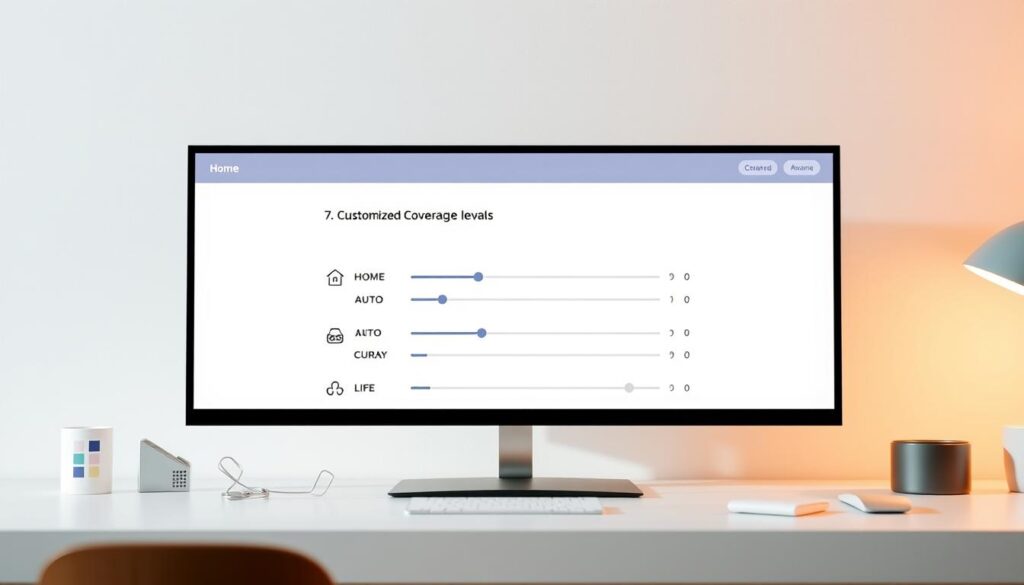

Features of Comprehensive Insurance Solutions

Balancing cost and coverage is easier with programs designed to reward proactive clients. Modern insurance solutions prioritize flexibility, allowing adjustments as lifestyles evolve. Whether managing a family home or a growing business, these plans adapt to shifting priorities.

Discounts, Savings, and Added Benefits

Bundling home and car policies often unlocks tiered discounts – some providers offer up to 25% savings. Safe drivers benefit from reduced rates, while multi-vehicle households enjoy streamlined billing. Loyalty programs and claim-free histories further lower premiums over time.

The Brand New Belongings® program replaces damaged household items at current market value, not depreciated costs. For auto claims, On Your Side® Claims Service accelerates repairs through a nationwide network of certified shops. These extras transform standard coverage into proactive asset management.

- Annual policy reviews ensure coverage aligns with life changes like renovations or new drivers

- Usage-based tracking reduces car insurance costs for low-mileage commuters

- 24/7 digital portals provide real-time information about claims and deductibles

Agents simplify complex decisions by explaining coverage nuances in plain language. This personalized approach helps families and businesses build safeguards that grow with their needs.

Expert Guidance and Local Support

Local expertise transforms complex decisions into confident choices. Bluebonnet Agency, based on Highway 29, combines decades of hands-on knowledge with personalized attention. Their team specializes in crafting plans for vehicles and businesses, ensuring every client’s unique situation receives focused care.

Professional Service and Claims Assistance

Clients work directly with agents who prioritize long-term relationships over quick sales. These professionals review policies annually, adjusting coverage as life evolves. Whether adding a new driver or expanding a business, they ensure protections align with current needs.

During claims, the company’s 24/7 support network accelerates resolutions. Customers report incidents via phone, app, or in-person visits, receiving updates at every step. This transparency reduces stress when handling repairs or replacements.

Local agents understand regional risks – from seasonal weather patterns to commuter challenges. Their insights help clients avoid gaps in standard policies. One customer notes: “They explained flood coverage options I didn’t know existed, saving my home during last year’s storms.”

Tailored solutions build trust by addressing specific concerns. Agents simplify jargon-heavy documents, making terms accessible. This approach fosters loyalty while delivering peace of mind through every life change.

Integrating Business and Personal Protection

Balancing business operations with personal life demands smart risk strategies. Providers bridge this gap by aligning liability safeguards for companies with asset security for individuals. This dual approach ensures both professional and private priorities stay protected against unexpected challenges.

Liability and Asset Risk Management

Businesses thrive when specialized plans address industry-specific exposures. For example, a restaurant owner benefits from coverage for equipment breakdowns or foodborne illness claims. Meanwhile, personal policies shield homes and vehicles from accidents or natural disasters. Structured solutions prevent overlapping gaps that could jeopardize financial stability.

Experienced agents evaluate client needs through detailed audits. They identify vulnerabilities like underinsured commercial properties or insufficient personal umbrella policies. Partner networks like Nationwide enable flexible billing options, including split payments or annual discounts for bundled services.

| Coverage Type | Key Protections | Risk Management Strategies |

|---|---|---|

| Business | Liability lawsuits, property damage, employee injuries | Custom endorsements, cyber insurance, business interruption plans |

| Personal | Home disasters, auto accidents, identity theft | Umbrella policies, scheduled personal property coverage, safe driver programs |

One retail store avoided bankruptcy after a fire using business interruption coverage. Their policy covered lost income during repairs while personal assets remained untouched. Agents regularly update plans as clients expand operations or acquire high-value items, ensuring evolving needs stay prioritized.

Key Advantages of pride insurance

Choosing the right coverage partner simplifies managing life’s uncertainties. This provider stands out by prioritizing convenience and clarity, ensuring clients spend less time on paperwork and more time protecting what matters.

Streamlined Policy Reviews and Member Resources

Annual policy updates no longer require lengthy meetings. Members complete digital checklists that highlight coverage gaps or savings opportunities. Agents then propose adjustments via secure portals, reducing back-and-forth emails.

Round-the-clock access to resources keeps customers informed. Mobile apps provide instant policy details, claim status updates, and emergency contact information. One user shared: “I resolved a fender bender at midnight using their app – no phone call needed.”

Detailed liability analysis strengthens protection for homes and businesses. Experts review risks like property damage lawsuits or customer injury claims, recommending tailored safeguards. This proactive approach prevents coverage shortfalls during crises.

Local agencies build trust through face-to-face service. Clients value working with neighbors who understand regional challenges, from storm seasons to traffic patterns. This community connection ensures personalized attention without corporate call-center delays.

- Digital tools minimize paperwork during policy changes

- 24/7 claim filing accelerates resolutions

- Risk assessments prioritize critical coverage areas

These advantages create lasting relationships built on reliability. Customers stay confident their evolving needs remain prioritized through every life stage.

Conclusion

Securing your assets and future requires a partner committed to personalized protection. Pride Insurance delivers comprehensive solutions for homes, vehicles, and businesses through adaptable policies and local expertise. Their approach combines detailed risk assessments with transparent service, ensuring clients only pay for what they need.

Tailored plans address unique challenges – from protecting renovated homes to managing commercial liabilities. Bundling multiple policies often unlocks savings while simplifying management. Clients gain access to 24/7 digital tools and agents who explain complex terms in plain language.

Staying informed about evolving needs helps families and businesses make smart decisions. Regular policy reviews and “Brand New Belongings®” replacement programs demonstrate their proactive approach. Local teams prioritize quick claim resolutions through nationwide networks.

Ultimately, choosing the right partner means balancing cost-efficiency with reliable safeguards. With Pride Insurance, customers secure more than property – they protect their livelihoods and peace of mind through every life change.

FAQ

What factors determine the right coverage for a house or vehicle?

Key considerations include property value, location, driving habits, and state requirements. Providers assess risks like natural disasters, theft rates, or accident history to tailor plans that balance affordability and protection.

How can customers save on bundled policies?

Bundling home and car plans often unlocks discounts. Additional savings may come from safety features like alarms, anti-theft devices, or maintaining a strong credit score. Seasonal promotions or loyalty rewards may also apply.

What specialized options exist for high-value assets?

Custom solutions might include extended replacement cost coverage for homes, agreed-value protection for classic cars, or riders for jewelry/art collections. Business owners can add commercial liability endorsements to personal policies.

How quickly are claims processed after an incident?

Most providers aim to resolve claims within 30 days for straightforward cases. Digital tools like photo submissions or video calls accelerate assessments. Dedicated agents guide clients through documentation needs for complex situations.

Does standard protection extend to home-based businesses?

Basic homeowner plans rarely cover commercial activities. Separate endorsements or business policies are recommended to safeguard equipment, inventory, and client liability exposures. Consultants help identify specific risks based on operations.

What resources simplify annual policy reviews?

Many companies offer online portals with coverage summaries, deductible calculators, and renewal alerts. Mobile apps let users compare rates, adjust limits, or request agent consultations within minutes.